Most revenue teams focus on filling the funnel without realizing how much growth quietly leaks out in the middle.

Most teams think their revenue problem starts at the top of the funnel. It rarely does. Deals die much later - in the middle, where momentum fades quietly and dashboards don’t show the full story. A proposal sits unanswered. A once-keen prospect goes dark. A single stakeholder blocks sign-off.

The damage compounds fast. A deal that lingers for 90 days instead of 45 distorts forecasts, inflates acquisition costs, and burns time that could have gone into the next opportunity. When that pattern repeats across dozens of accounts, growth slows even if the win rate hasn’t changed.

That’s why pipeline velocity has become a board-level discussion. The question isn’t “how do we close faster,” but “how do we remove friction before it slows us down?”

AI is starting to answer that. By spotting early risk signals, such as a quiet buying group, an unengaged champion, or an unusually long approval stage, predictive systems are helping teams act before deals stall. The result isn’t forced speed; it’s healthier momentum and more predictable revenue flow.

What Is Pipeline Velocity (and How It’s Calculated)

Pipeline velocity measures how efficiently opportunities move through your funnel, and not how many you have in it.

The formula is simple:

Pipeline Velocity = (Number of Qualified Opportunities × Win Rate × Average Deal Size) ÷ Sales Cycle Length

Image source: Hubspot

On paper, it looks like a math problem. In practice, it’s a window into your revenue engine’s health. It shows how fast potential value turns into real revenue, and where deals tend to lose speed.

For leadership teams, tracking pipeline velocity alongside CAC (Customer Acquisition Cost) and LTV (Lifetime Value) gives a more complete picture of growth efficiency. CAC tells you how much you spend to win business. LTV tells you how much value that business creates. Pipeline velocity fills the middle gap: how long it takes for those investments to pay off.

The mistake many companies make is treating pipeline velocity as a sales productivity metric. It’s not about pushing reps to close faster or cramming more calls into a week. It’s about diagnosing friction: whether your qualification criteria are too loose, your deal sizes are mismatched to buyer intent, or your average cycle length is dragging because marketing handed over leads too early.

When measured consistently (monthly or quarterly) velocity becomes a forecasting stabilizer. It helps you determine whether growth targets are achievable with your current pipeline or if new demand needs to be generated.

Why Pipeline Velocity Optimization Drives Revenue Growth

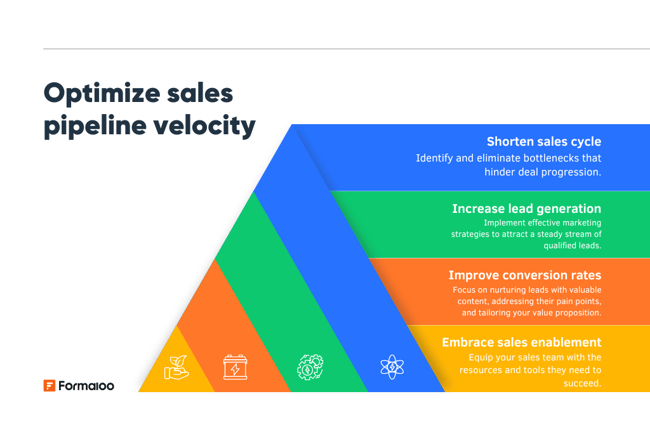

Faster pipelines don’t just close deals sooner; they compound growth. A sales cycle that’s 15 days shorter this quarter frees capacity for more deals next quarter. Multiply that across the year, and you’re accelerating revenue recognition without increasing headcount or spend.

That’s where AI buyer intent prediction turns insight into action. Machine learning models analyze millions of behavioral combinations and rank leads based on their probability of conversion, rather than arbitrary point systems, by statistically proven buying patterns.

Image source: Fromallo

B2B companies that consistently improve pipeline velocity often see 20–30% faster revenue realization, not because they chase harder, but because they execute cleaner.

Velocity Improves Predictability and Confidence

Faster, healthier pipelines give leadership what every board wants: accurate forecasting. When deal stages move at a consistent pace, revenue projections stabilize, and decision-making becomes sharper. Finance can plan investments with confidence, and go-to-market teams can focus on scaling rather than scrambling to hit unpredictable end-of-quarter gaps.

Predictable pipelines reduce surprises and improve trust between departments. Marketing can show its true contribution to acceleration, while sales gains credibility in the boardroom for reliable forecasting.

Velocity Enhances Capital Efficiency

It’s simple: when revenue lands earlier, capital can be reinvested sooner, whether into new campaigns, product innovation, or market expansion. This is what turns velocity into a growth multiplier, not just an efficiency metric. The same headcount, budget, and pipeline value now produce more cycles of return in a given period.

In markets where liquidity and timing drive advantage, shaving even a few weeks off deal cycles can directly influence quarterly earnings and valuation. Velocity optimization, in that sense, becomes a strategic lever for CFOs as much as CROs.

Velocity Elevates the Buyer and Team Experience

A faster pipeline benefits both the business and the buyer. When communication is consistent and friction is low, decisions feel easier. Long, disjointed buying journeys exhaust stakeholders; clear, streamlined ones build trust and momentum.

For internal teams, shorter cycles also mean less burnout. Sales reps aren’t chasing cold deals for months, and marketing sees campaign impact sooner. The entire go-to-market machine operates at a sustainable, not frantic, rhythm.

See also: How AI is Transforming the B2B Sales Pipeline

Where Pipelines Slow Down and How to Spot Bottlenecks

AI-powered intent isn’t plug-and-play; it’s a system that only works as well as the data feeding it. Here’s how to make sure it performs like an asset, not a distraction.

Every company has a stage where deals quietly lose steam. It’s rarely the same for everyone, but it’s almost always predictable once you look at the data.

The most common friction points include:

- Deals stalling after the proposal. Momentum fades when pricing goes out too soon or without a strong internal advocate. A deal that looks healthy on paper may sit untouched for weeks while buyers chase internal approvals or quietly deprioritize the project.

- Weak or single-threaded champions. Relying on one contact to carry the deal creates fragility. When that person loses influence or moves on, the entire opportunity can collapse overnight.

- Poor lead-to-opportunity handoff. When marketing passes leads before they’re ready, sales waste valuable time re-qualifying rather than progressing. The result is inflated pipeline volume with little actual velocity.

- Lack of sales–marketing alignment. Misaligned messaging or unclear definitions of “qualified” slow the buyer’s journey and erode trust. Misaligned messaging, inconsistent qualification criteria, or competing incentives can add days (or weeks) to the buyer’s decision process.

Finding the Real Bottlenecks

Pinpointing where velocity leaks requires data visibility across the entire funnel, not isolated metrics in CRM reports. Track time spent at each stage, communication frequency, and engagement depth. When you compare these data points, recurring choke points surface quickly; perhaps proposals linger longer in one vertical, or deals handled by a certain team consistently stall after demos.

Look for:

- Which stage consistently adds the most delay?

- Which rep or region shows a higher drop-off?

- Where handoffs or follow-ups break down.

Marketing’s Role in Maintaining Velocity

For marketing leaders, this is where accountability shifts from lead volume to lead quality.

A pipeline packed with unqualified names is deferred revenue, not growth. When marketing focuses on momentum instead of quantity, alignment with sales naturally improves, and forecasting becomes more reliable.

|

Turn Pipeline Insights into Revenue Momentum See how our team helps marketing and sales leaders identify bottlenecks, accelerate deal flow, and improve revenue forecasting with data-backed strategies. Book a free strategy session today. |

How AI Enhances Pipeline Velocity Optimization

The most effective revenue teams no longer wait for deals to stall because they can see it coming. That’s the new advantage of AI: turning lagging indicators into leading ones.

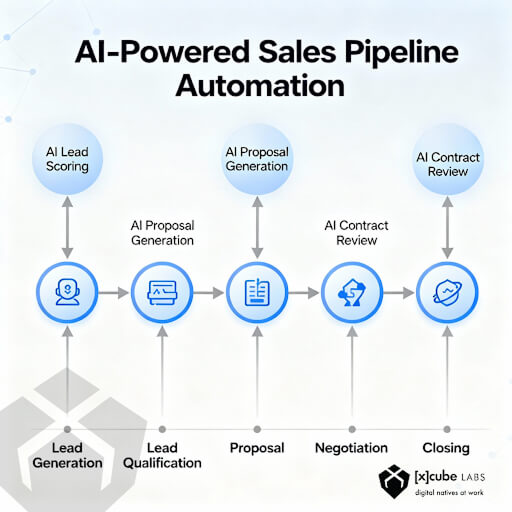

Image source: XCubeLabs

Early Risk Detection

AI systems continuously analyze deal behavior, such as email frequency, meeting patterns, and content engagement, to identify subtle signs of friction. When activity drops or sentiment shifts, predictive models flag the risk before it appears in the forecast.

For example, conversation intelligence can detect a buyer’s uncertainty about budget or timeline long before the rep logs a “concern” note. Engagement scoring highlights when key stakeholders have gone quiet, helping managers re-engage the right contacts before momentum disappears.

Next-Best Action Modeling

Beyond detection, AI increasingly recommends what to do next. It learns which interventions historically revived stalled deals, bringing in a product expert, sharing a proof-of-concept, or escalating executive alignment, and suggests similar actions in real time.

Turning Insights into Marketing Action

For marketing teams, these insights extend far beyond the sales dashboard. Predictive signals can trigger re-nurture campaigns targeted at specific hesitation points, or retargeting sequences aimed at dormant stakeholders who show renewed interest online. AI also uncovers opportunities to multi-thread by revealing other decision-makers engaging with your content inside the same account. Together, these moves transform sales data into marketing precision.

AI as an Amplifier, Not a Replacement

AI doesn’t remove the need for human judgment; it amplifies it. It provides leaders with a faster and clearer view of what’s happening inside the funnel, allowing them to make decisions with context rather than intuition.

See also: Close More Deals With AI-Driven Lead-to-Opportunity Scoring

Turning Insights into Action: Best Practices for Leaders

Pipeline velocity optimization only works when insights become habits. The real challenge isn’t finding data, but operationalizing it across marketing, sales, and RevOps so everyone acts on the same signals.

1. Build a Shared KPI Framework

Velocity is a team sport. Marketing influences it at the top, sales drives it in the middle, and RevOps sustains it end-to-end. Establish shared KPIs that align all three, such as:

- Time-in-stage targets to prevent deals from idling too long.

- Marketing’s contribution to acceleration, measured by influenced opportunities or re-engagement lift.

- Predictive close likelihood benchmarks, giving both teams a common forecast language.

When everyone is measured against the same velocity outcomes, alignment stops being a talking point and becomes part of daily performance.

2. Move from Reporting to Real-Time Coaching

Traditional reporting looks backward. By the time a slowdown appears in a dashboard, the quarter’s impact is already locked in. Replace static reports with proactive alerts and playbooks - automated signals that flag when a deal exceeds its average time-in-stage or engagement drops below a threshold.

Sales managers can then intervene early, while marketing triggers reactivation campaigns or customer proof points to rebuild urgency.

3. Create a Velocity Dashboard that Drives Focus

A dedicated dashboard should track more than the total pipeline value. The most effective teams monitor:

- Average time-in-stage (by deal size or segment)

- Predicted close probability (AI-calculated)

- Marketing acceleration metrics, such as content engagement before proposal or ad retargeting influence

When reviewed weekly, these indicators show not only how much pipeline exists, but how fast it’s moving.

4. Make Pipeline Velocity Reviews a Habit

Add “velocity reviews” to quarterly business reviews (QBRs). Discuss cycle-time improvements and stage-specific friction the same way you’d review win rates or revenue. This shifts the culture from purely outcome-based to efficiency-focused.

Celebrate when the team shortens the average cycle, not just when they hit quota. Faster cycles mean healthier revenue rhythm, better cash flow, and less operational drag.

|

Let’s Build a Pipeline That Moves With You From data to decision-making, we help align your marketing, sales, and RevOps teams around what really drives momentum, not just activity. Book a free strategy session today. |

Measuring Success: Metrics That Prove Velocity Gains

Optimizing pipeline velocity isn’t a one-time project, but a continuous performance loop. The right metrics ensure your teams stay focused on progress that directly ties to revenue impact.

Core Pipeline Velocity Metrics

Track a mix of cycle, conversion, and reliability indicators to understand where gains are coming from:

- Average sales cycle length: The clearest measure of speed improvement.

- Win rate: Reveals whether velocity is improving deal quality, not just speed.

- Forecast accuracy: More predictable cycles lead to tighter forecasts and better resource planning.

- Revenue recognition time: Shows how quickly closed deals convert to realized income.

Together, these metrics provide a 360° view of both the pace and health of your revenue engine.

Quantifying the ROI of Velocity Gains

To make the business case tangible, calculate the direct financial value of acceleration:

ROI = Days Saved × Average Daily Revenue Value

For example, if you shorten the average sales cycle by 10 days and your daily recognized revenue is $50,000, that’s $500,000 in earlier revenue realization, without adding headcount or spend.

This framing resonates in boardrooms because it connects operational efficiency to financial performance, not just productivity.

Benchmark by Segment

Velocity benchmarks vary widely between SMB, mid-market, and enterprise. An SMB deal might close in three weeks, while enterprise deals take months, but the key is trend consistency. Are your cycles shrinking within each segment? Are enterprise approvals moving faster?

Comparing velocity across tiers, deal types, and regions gives leadership insight into where acceleration efforts truly pay off.

Keep Speed and Quality in Balance

Finally, remember that faster isn’t always better if it compromises deal quality or retention. The goal of velocity optimization is steady, reliable throughput, not rushed closes that churn later. Measure post-sale outcomes alongside pre-sale speed to ensure your gains are sustainable.

See also: Predictive Buyer Intent with AI: Turning Digital Clues into Revenue Opportunities

Pipeline Velocity as a Strategic Growth Lever

Pipeline velocity is about working smarter, not harder. Pressure creates noise; precision creates momentum. When you understand where friction forms and eliminate it before it slows a deal, you start to see the real levers behind predictable growth.

The goal isn’t speed for speed’s sake, but revenue efficiency: turning opportunity into recognized revenue sooner, with fewer surprises along the way. Every day you shave off a sales cycle compounds across quarters. It frees capital, sharpens forecasts, and builds confidence in your growth engine.

AI just makes that precision easier. It surfaces early warnings you’d otherwise miss and helps leaders act before problems become patterns. The companies using it aren’t just improving deal velocity; they’re building pipelines that practically run themselves.

|

Want to See Where Your Pipeline’s Slowing Down? We’ll help you analyze your funnel, pinpoint friction, and design a data-driven plan to shorten cycles without cutting corners. Book a free strategy session with our team. |

FAQs

1. What’s the difference between improving pipeline velocity and increasing lead volume?

Boosting lead volume fills the top of your funnel; improving velocity strengthens how deals move through it. You can double your leads and still miss targets if opportunities stall mid-pipeline. Velocity optimization ensures the growth you create actually converts into cash flow.

2. How does pipeline velocity affect marketing ROI?

Velocity turns marketing from a cost center into a growth multiplier. When high-intent opportunities progress faster, campaign impact becomes easier to attribute — and marketing’s influence on revenue gets clearer at the executive level.

3. Can AI actually predict which deals will stall?

Yes, and often with more accuracy than human forecasting. AI identifies behavioral shifts like reduced engagement, declining reply rates, or missing stakeholder activity that typically precede a stall. It doesn’t replace human judgment, but it gives leaders a clearer early-warning system.

4. What are the early signs of a slowing pipeline that leaders tend to miss?

Watch for subtle indicators: pipeline value holding steady while closed revenue drops, growing average time-in-stage, or a spike in “no decision” outcomes. These patterns signal systemic drag, not just seasonal slowdown.

5. How should marketing and sales jointly own velocity?

Treat it as a shared KPI, not a departmental metric. Marketing can shorten early-stage friction with better lead scoring and content alignment, while sales improves mid- to late-stage momentum through stakeholder mapping and tighter follow-ups. When both sides measure progress by stage movement, alignment becomes measurable, not theoretical.

6. What’s a realistic goal for pipeline velocity improvement?

Start with incremental progress - even a 10–15% reduction in average cycle time can have a major impact on recognized revenue. The key is consistency: sustain those gains quarter over quarter, rather than chasing one-time spikes.